FSA & METI — Venture Capital: Recommendations and Expectations

The Financial Services Agency (FSA) and the Ministry of Economy, Trade and Industry (METI) jointly held the “Expert Panel on Venture…

The Financial Services Agency (FSA) and the Ministry of Economy, Trade and Industry (METI) jointly held the “Expert Panel on Venture Capital Funds” from April to June 2024, in order to encourage the development of the VC sector.

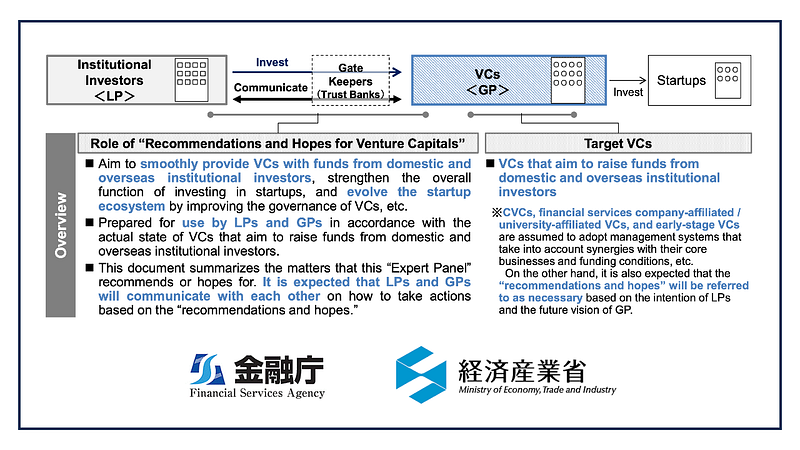

After public consultation, the Expert Panel finalized and published the paper “Venture Capital: Recommendations and Expectations” (unfortunately translated as “Hopes” in the FSA-published English summary), which outlines the recommended and expected practices for Venture Capital firms in Japan, particularly those seeking funding from domestic and international institutional investors. It aims to enhance the attractiveness of VC as a long-term asset class, foster the growth of the VC industry, and ultimately contribute to the development of a thriving startup ecosystem.

Background and Context

The Japanese government has prioritized fostering a positive cycle of growth and distribution, recognizing the crucial role of institutional investors in channeling household financial assets towards growth companies. This led to the establishment of a task force on asset management under the Financial System Council’s Market Working Group.

The task force highlighted the importance of strengthening the investment value chain, where household funds flow to asset management companies, then to growth companies via investments, and finally back to households as returns. This underscored the significance of Venture Capital (VC) in supplying growth capital to startups.

A joint report by the task force and the Market Working Group in December 2023 included recommendations to facilitate the flow of domestic and international institutional investor funds to Japanese startups through VCs. This involved promoting fair value assessments of VC investments and aligning domestic VC operations with global best practices in governance and information disclosure.

The report also proposed developing “Venture Capital Principles” to enhance the attractiveness of VC as a long-term asset class and improve the overall governance standards of VCs seeking funding from institutional investors. This initiative was further emphasized in the “Asset Management Nation Realization Plan.”

Following these recommendations, the “Expert Panel on Venture Capital” was established, jointly hosted by the Financial Services Agency (FSA) and the Ministry of Economy, Trade and Industry (METI), holding three meetings from April 2024. Based on these discussions, a draft of “Recommended and Expected Practices for Venture Capital” was published on July 4, 2024. Following a public comment period, the final version was published on the FSA website on November 8, 2024.

Objective of the Recommended and Expected Practices

The primary goal of these practices is to enhance the appeal of VC as a long-term investment, bolster the growth of the VC industry, and facilitate funding for startups. They address recommended and expected practices for both Limited Partners (LPs — investors in the fund) and General Partners (GPs — fund managers) of VCs seeking broad investor participation.

The Japanese VC market has expanded rapidly in recent years, and VCs are expected to play an increasingly important role in funding startups. However, Japanese VC fund sizes are relatively small compared to those in the US. Currently, most funding for Japanese VCs comes from corporations, but these practices aim to encourage greater participation from institutional investors. By aligning with international best practices and considering Japanese market characteristics and individual VC circumstances, these practices are intended to enhance VC governance, facilitate smoother capital flow from domestic and international institutional investors, and promote the growth of later-stage investments, contributing to the development of a world-class startup ecosystem.

Approach

The document adopts a principles-based approach rather than strict rules. VCs are expected to apply the practices flexibly based on their individual circumstances, engaging in open communication between LPs and GPs about any deviations and their rationale. The practices are intended to guide LPs in their investment decisions and GPs in their fund management operations. They are not meant to be externally evaluated or enforced.

Scope of Application

These practices are intended for VCs seeking funding from a wide range of domestic and international institutional investors. VCs may choose not to implement some practices, and in such cases, open communication with LPs about the rationale and future plans is encouraged. Other types of VCs, such as Corporate Venture Capitals (CVCs), financial institution, or university-backed VCs, may have unique governance structures and should consider these practices as appropriate. Early-stage VCs are expected to adapt their operations based on their size and funding status but should consider these practices as they plan for future growth and broader investor participation.

Structure of Recommended and Expected Practices

The document is divided into two sections:

- “Recommended Practices”: These are practices that VCs are encouraged to adopt to fulfill their fiduciary responsibilities to LPs and attract investment from institutional investors.

- “Expected Practices”: These are broader goals aimed at promoting the startup ecosystem and enhancing long-term returns for LPs. They acknowledge the diversity of VC strategies and emphasize open communication between LPs and GPs. GPs are expected to prioritize their fiduciary duty to LPs while also playing a crucial role in nurturing startups.

The document emphasizes that implementing these practices is ultimately left to the discretion of individual LPs and GPs.

Follow-up

The practices are based on current market practices and the perspectives of institutional investors, considering the future development of the Japanese startup ecosystem. Recognizing that market conditions and best practices may evolve, the document calls for ongoing monitoring and review by stakeholders, including industry groups, to ensure the continued relevance of these practices. The expert panel will consider follow-up and revisions as needed.

Details of Recommended and Expected Practices

The document further details specific recommended and expected practices under several key areas, including:

- Fiduciary Duty and Governance: Emphasis on maximizing LP returns, establishing clear lines of communication between LPs and GPs, potentially through a Limited Partner Advisory Committee (LPAC).

- Building a Sustainable Management Structure: Ensuring key personnel dedication to fund management, addressing key person departures, and building a robust team for continuity.

- Compliance Management: Establishing compliance frameworks, including designation of a compliance officer, handling of non-public information, and adherence to relevant laws and fund agreements.

- Transparency of LP Rights: Ensuring fairness among LPs and avoiding granting individual LPs preferential rights without transparency and justification.

- Conflict of Interest Management: Identifying and managing potential conflicts of interest, especially in cases of multiple fund management or external business activities.

- Alignment of LP and GP Interests: Encouraging appropriate GP commitment to the fund and aligning profit-sharing structures with global standards like the ILPA Private Equity Principles.

- Information Disclosure: Providing quarterly financial information to LPs and annual reports covering investment strategy implementation and future plans.

- Investment Agreement with Startups: Structuring agreements to align incentives and avoid hindering startup growth or future fundraising.

- Support for Portfolio Companies: Providing various forms of support, including introductions to talent, business matching, and M&A advisory.

- Support for Portfolio Companies’ Capital Policy: Assisting with further fundraising rounds, potentially through follow-on investments or introductions to other investors.

- Post-IPO Support and Exit Strategies: Careful consideration of exit timing and methods to maximize returns, including the possibility of cross-over investments.

- ESG and Diversity: Encouraging consideration of ESG factors in fund operations and promoting diversity within the startup ecosystem.

This document provides a valuable framework for the development and maturation of the Japanese VC industry, aiming to attract more institutional capital and ultimately contribute to a more vibrant startup environment.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.