First Metaplanet, now Remixpoint

Metaplanet's positioning as the "Japanese MicroStrategy" is quite well understood at this point. CEO Simon Gerovich laid out their strategy very clearly during the WebX 2024 conference:

Metaplanet's Strategy: Massive Bitcoin Purchases

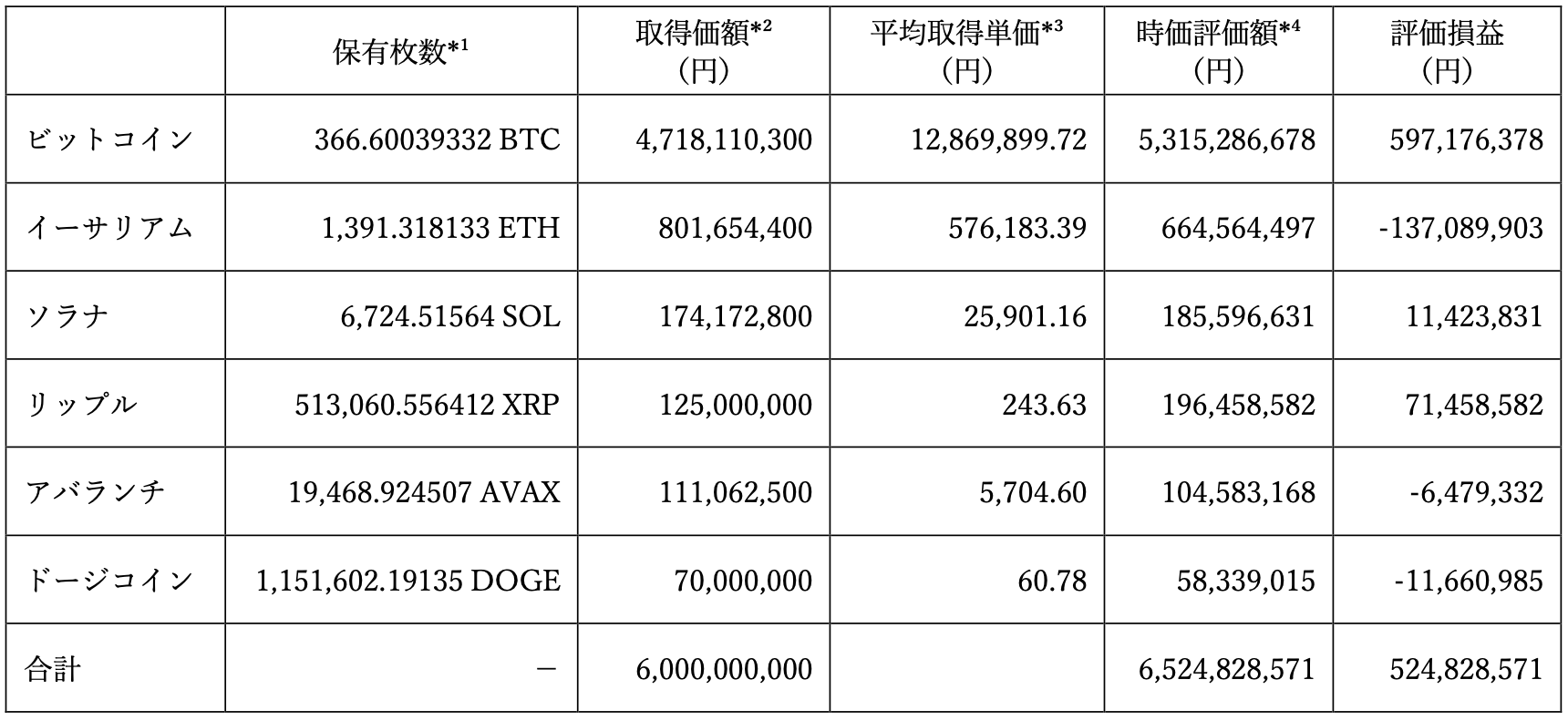

Enter Remixpoint, a new player who has been actively investing in cryptocurrencies. The company initially invested 5 billion yen by the end of 2024 and has recently decided to increase its holdings by an additional 3 billion yen. As of January 13, 2025, Remixpoint's total investment in cryptocurrencies stands at 6 billion yen, with a total valuation of approximately 6.52 billion yen, resulting in a net unrealized gain of around 524 million yen. The primary cryptocurrency holdings are Bitcoin, Ethereum, Solana, Ripple, Avalanche, and Dogecoin. The company cites recent market trends, institutional investor interest, the Bitcoin halving, and US presidential election results as reasons for their investment strategy.

Key Themes and Important Ideas

- Aggressive Cryptocurrency Investment: Remixpoint is actively and increasingly investing in cryptocurrencies. The company's initial investment of 5 billion JPY was followed by an additional planned investment of 3 billion JPY. As of January 14th, 2025, they've invested 6 billion JPY.

- Strategic Rationale: The decision to invest in crypto is based on a perceived favorable market environment and long-term potential.

- Diversified Portfolio: The company is not solely investing in Bitcoin but holds a portfolio including other notable cryptocurrencies like Ethereum, Solana, Ripple, Avalanche, and Dogecoin.

- Mark-to-Market Accounting: Remixpoint evaluates its cryptocurrency holdings quarterly, recognizing gains or losses on the income statement.

- Gradual Investment: The 3 billion JPY additional investment isn't made in a lump sum. The company is allocating this capital gradually, purchasing 500 million JPY worth of Bitcoin on January 9 and another 500 million JPY on January 10th. The remaining 2 billion JPY will be invested "according to market conditions."

- Transparency: Remixpoint is promptly disclosing its cryptocurrency purchases and the resulting changes in their holdings to the market.

Cryptocurrency Holdings

Risk Management

Remixpoint has established guidelines for cryptocurrency purchase and risk management, which were initially outlined in a September 26, 2024, announcement. The company acknowledges the volatility associated with cryptocurrencies and has stated that it will disclose information if there is a significant impact to their consolidated financial results.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.