Digital Garage's third quarter results

Digital Garage's third-quarter report for the fiscal year ending March 2025, released on February 10, 2025, paints a picture of a company successfully navigating a complex technological landscape and making substantial progress towards its strategic goals. The overarching theme is one of consistent growth, particularly within the core payment segment, driven by strategic alliances and technological advancements. The financial performance shows a company on track to meet its full-year profit growth targets, demonstrating resilience and adaptability in a dynamic market.

The company's stated purpose is to design a "New Context" for a sustainable society, utilizing technology. This purpose is underpinned by the "First Penguin Spirit," a value reflecting the company's proactive and pioneering approach. This ethos translates into the corporate slogan: "New Context Designer DG." This context-driven design approach is not just philosophical; it's deeply ingrained in the company's operational structure.

Digital Garage's business model is built upon the convergence of three core technologies: Information Technology (IT), Marketing Technology (MT), and Financial Technology (FT). The interconnectedness of these technologies is crucial. It allows the company to capture the ongoing evolution of technology and ensure continuous business growth. This integrated structure provides a robust foundation for adapting to shifts in the digital realm.

The historical context of Digital Garage's evolution is significant. Since its inception in 1995, the company has consistently deployed cutting-edge internet technologies, initially focusing on marketing and payment solutions. Looking forward, the company's next-generation focus will be on Generative AI, web3, and other emerging technologies. This forward-looking vision positions them at the forefront of the next wave of digital transformation.

The company's journey, illustrated in a historical timeline, spans several key phases. It began with Portal Search in 1995, moved through E-commerce and Vertical Media in the 2000s, and embraced Social Media around 2008. More recently, from 2016 onwards, the focus has shifted to Blockchain technology. This timeline reveals a clear progression, adapting to and shaping the evolution of the internet. Currently, the enterprise's medium term plan is shaped by Gen AI/web3 in the technology domain, and its ongoing payment business.

Digital Garage's operations are organized into distinct business segments: the Platform Solution (PS) segment, the Long-term Incubation (LTI) segment, and the Global Investment Incubation (GII) segment. The PS segment is further divided into Fintech and Digital Marketing, reflecting the core technological strengths. The LTI segment focuses on media, retail tech, real estate, B2B, and web3, and contains a number of related sub-brands. GII is focused on global startups, and includes DG's venture capital arm. These segments are interconnected through an "Enabling Businesses / Strategic Partners" network, which includes companies like Resona Holdings and Toshiba Tec Corporation. This network creates a synergistic ecosystem, with data and money flowing between the segments and fostering collaborative growth.

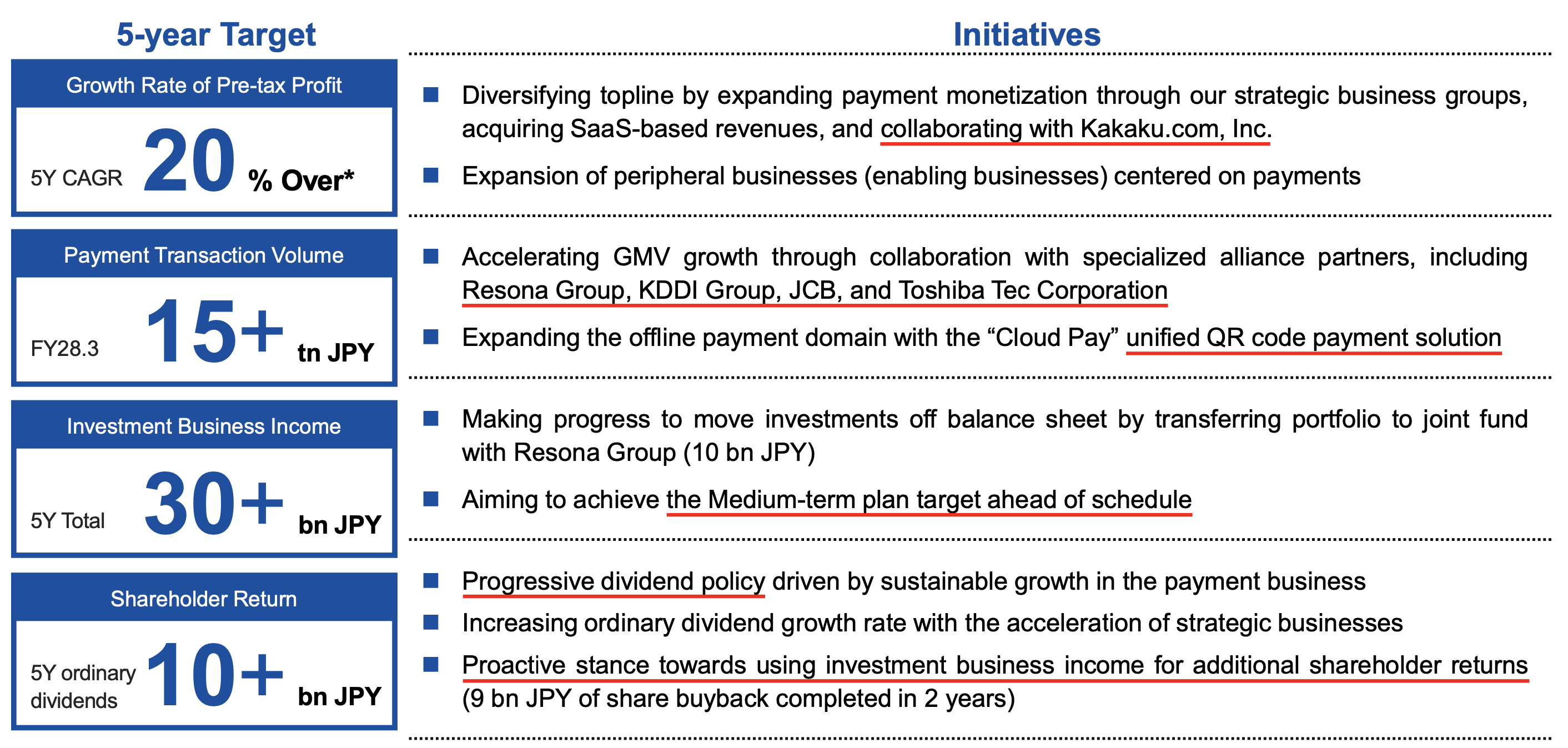

Within the company's medium-term plan (FY24.3 – FY28.3), ambitious targets are defined. A key objective is a 20% or greater compound annual growth rate (CAGR) of pre-tax profit. Another critical target is to achieve a payment transaction volume of over 15 trillion JPY by FY28.3. Furthermore, the plan aims for an investment business income exceeding 30 billion JPY over five years. These quantitative goals are complemented by a commitment to shareholder return, with a target of over 10 billion JPY in ordinary dividends over five years. These targets are not simply aspirational; the company is already demonstrating progress, aiming to achieve the medium-term plan ahead of schedule.

Key initiatives underpin these ambitious targets. The company is actively diversifying its revenue streams by expanding payment monetization, acquiring SaaS-based revenues, and collaborating with Kakaku.com, Inc. The expansion of "peripheral businesses," centered around payments, is also a priority. Accelerating GMV growth is being pursued through strategic alliances with major players like Resona Group, KDDI Group, JCB, and Toshiba Tec Corporation. The offline payment domain is being expanded with the "Cloud Pay" unified QR code payment solution. The company is also strategically shifting investments off its balance sheet, transferring portfolios to a joint fund with Resona Group. This financial maneuver enhances flexibility and reduces risk. Finally, a progressive dividend policy, driven by sustainable growth in the payment business, is a key element of the shareholder return strategy.

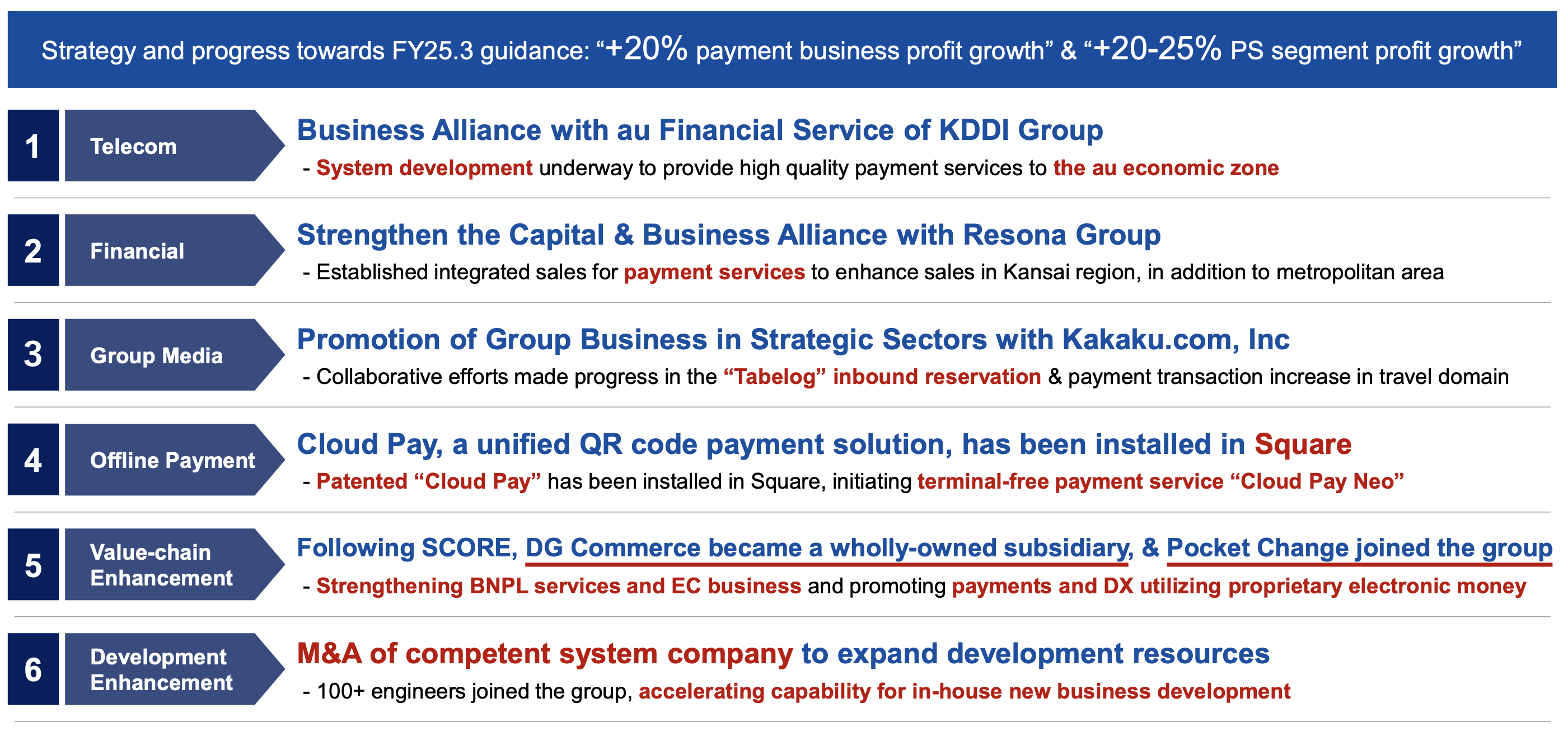

The progress of strategic actions during the third quarter is particularly noteworthy. The business alliance with au Financial Service of KDDI Group is progressing, with system development underway to provide high-quality payment services to the "au economic zone." This signifies a significant expansion into a major mobile ecosystem. The alliance with Resona Group is also strengthening, with integrated sales for payment services expanding into the Kansai region. This broadens the geographic reach of the company's payment solutions. Collaboration with Kakaku.com, Inc. is yielding positive results, with progress in "Tabelog" inbound reservation and increased payment transactions in the travel domain. This leverages the strengths of both companies in their respective sectors.

A significant technological advancement is the installation of "Cloud Pay," a unified QR code payment solution, in Square terminals. This allows for a terminal-free payment service, "Cloud Pay Neo," significantly expanding the reach and flexibility of the payment system. Furthermore, DG Commerce became a wholly-owned subsidiary, and Pocket Change joined the group, strengthening the value chain enhancement. This move strengthens BNPL (Buy Now, Pay Later) services, EC business, and promotes payments and digital transformation by utilizing proprietary electronic money. Finally, an M&A of a system company was undertaken, expanding development resources and adding over 100 engineers to the group. This bolsters the company's in-house development capabilities.

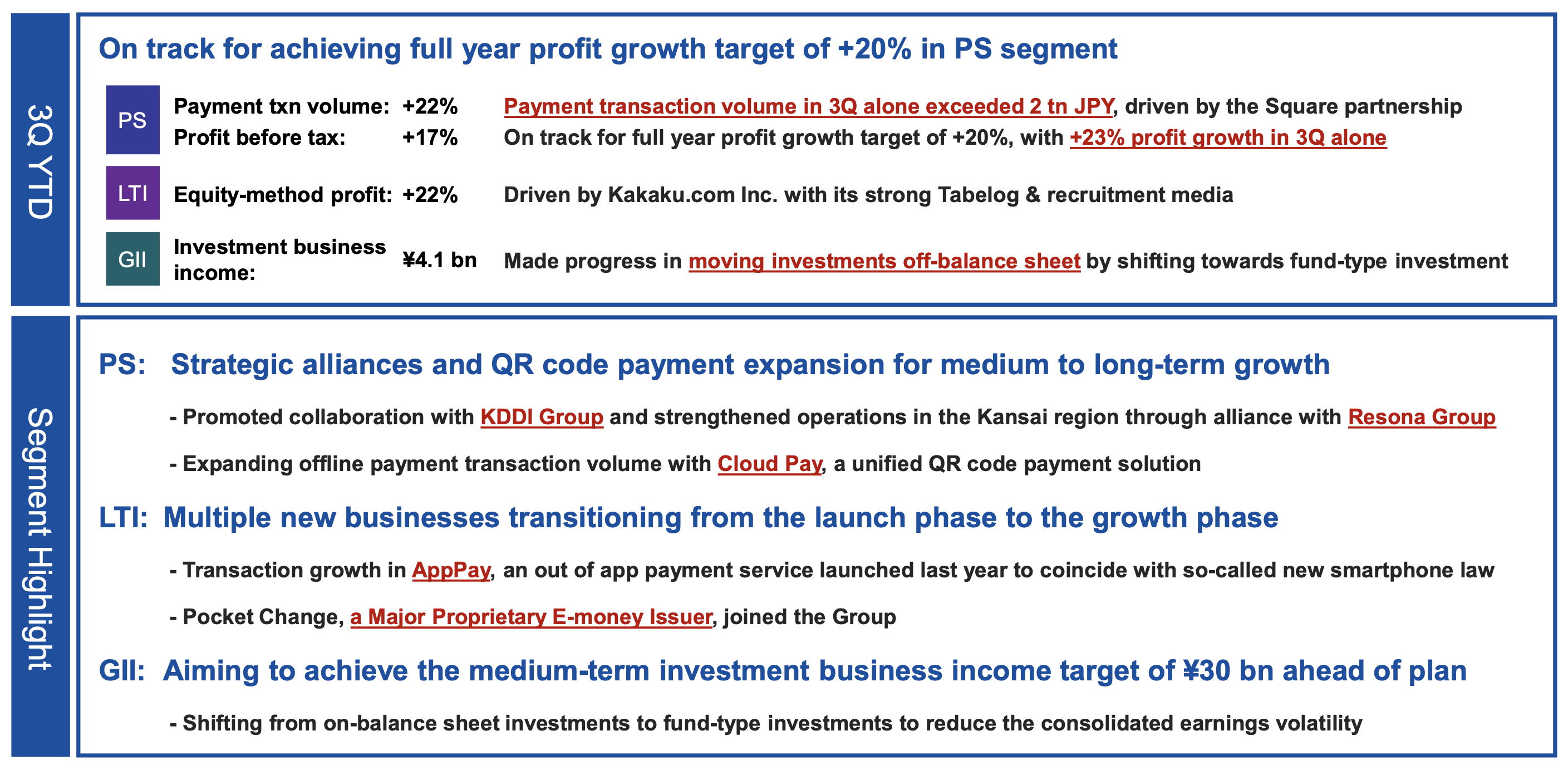

The financial highlights for the third quarter underscore the positive trajectory. The payment transaction volume increased by 22%, and the profit before tax increased by 17%. Notably, the payment transaction volume in the third quarter alone exceeded 2 trillion JPY, a testament to the success of the Square partnership. The equity-method profit, driven by Kakaku.com Inc., also increased by 22%. The investment business income reached 4.1 billion JPY, reflecting progress in moving investments off the balance sheet.

Strategic alliances and QR code payment expansion are key drivers of growth in the PS segment. Collaboration with KDDI Group and strengthened operations in the Kansai region through the alliance with Resona Group are crucial. The expansion of offline payment transaction volume with "Cloud Pay" is also a major factor. In the LTI segment, multiple new businesses are transitioning from the launch phase to the growth phase. The growth in AppPay transactions and the joining of Pocket Change, a major proprietary e-money issuer, are particularly significant. The GII segment is focused on achieving the medium-term investment business income target of 30 billion JPY ahead of plan, shifting from on-balance sheet investments to fund-type investments to reduce earnings volatility.

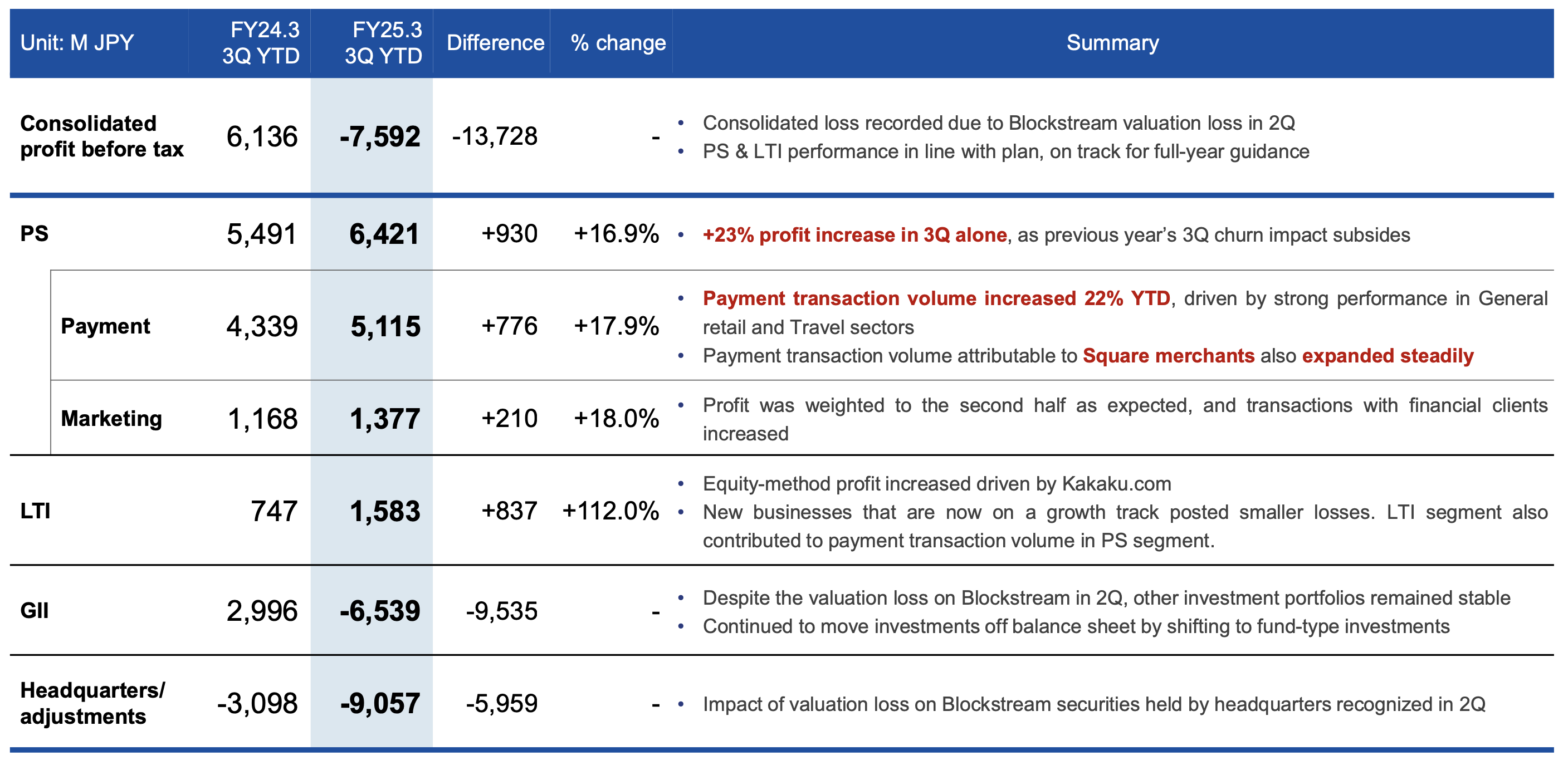

A detailed breakdown of the consolidated financial highlights reveals that the PS segment is performing in line with expectations, with a +23% profit increase in the third quarter alone. The payment transaction volume increased by 22% year-to-date, driven by strong performance in general retail and travel sectors. Transactions attributable to Square merchants also expanded steadily. Marketing profit was weighted to the second half as expected, with transactions with financial clients increasing. The LTI segment showed significant profit growth (+112.0%), driven by Kakaku.com and the contribution of new businesses that were previously posting losses. In the GII segment, despite a valuation loss on Blockstream, other investment portfolios remained stable, and the company continued to move investments off the balance sheet.

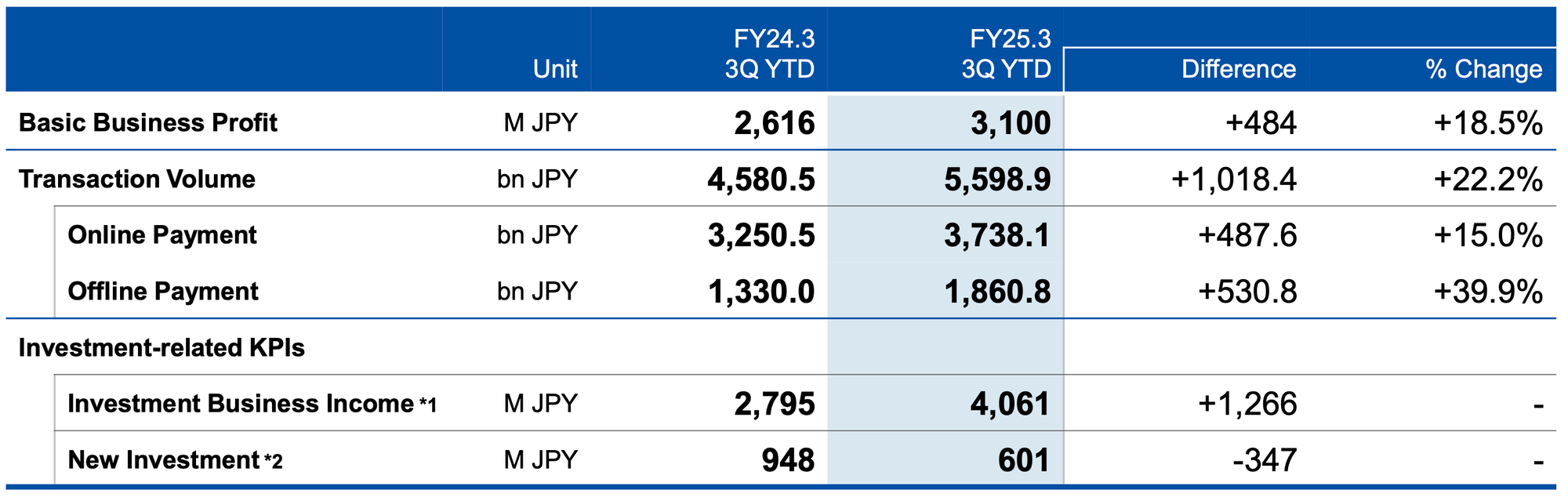

Key performance indicators (KPIs) provide further insights. The basic business profit showed stable growth (+18.5%), excluding investment business and one-time gains/losses. The transaction volume showed remarkable growth (+22.2%), with online payment increasing by 15.0% and offline payment surging by 39.9%. Investment-related KPIs showed a substantial investment business income of 4,061 million JPY.

The segment performance for the Platform Solution segment demonstrates a strong payment business driving the overall growth, while the Marketing business shows profits concentrated in the second half.

The LTI segment showed a strong increase in equity method profits, by 20%. In the GII, Investment business income was up, and there was progress in transitioning the investment portfolio to the joint fund with Resona.

Looking ahead, the Platform Solution (PS) segment is projected to achieve +20-25% growth, driven by the recovery from a one-time loss and strong business momentum. The payment business is expected to maintain a +20% full-year profit growth forecast. These projections reflect the company's confidence in its strategic direction and operational execution.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.