Digital Garage reports second quarter results

Digital Garage presented its second quarter earnings for the fiscal year ending March 2025 on November 7, 2024. Here are the key…

Digital Garage presented its second quarter earnings for the fiscal year ending March 2025 on November 7, 2024. Here are the key highlights:

- Strong Core Business Performance: Despite a non-cash accounting loss due to the fair value valuation of Blockstream and rapid Japanese Yen appreciation, Digital Garage’s core payment business demonstrated robust performance.

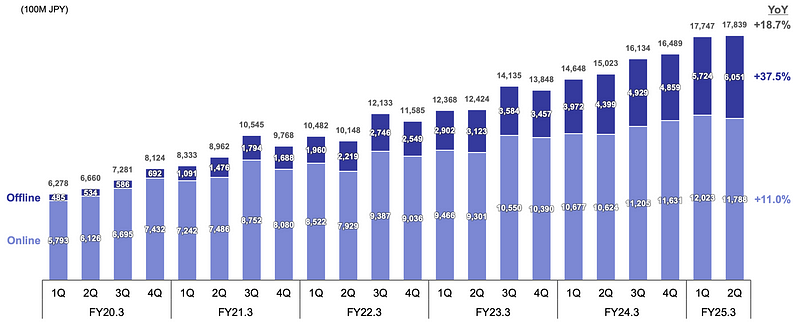

- Payment Business Growth: The payment business saw a 23% profit increase in Q2 alone and is on track for +20% full-year growth. Payment transaction volume increased by 20%, driven by growth in general retail, financial accounts, and restaurants, along with increased use of QR code payments, particularly Cloud Pay in offline areas.

- Cloud Pay Expansion: Cloud Pay, a unified QR code payment solution, was successfully launched on Square, a major U.S. payment platform, with positive implications for future results.

- Strategic Partnerships: Partnerships with Resona Group, KDDI, JCB, and Toshiba Tec Corporation are contributing to accelerating GMV growth.

- Long-Term Incubation (LTI) Segment Growth: Equity method profit increased by 24%, primarily driven by Kakaku.com’s performance, particularly Tabelog and Kyujin Box. Several new strategic businesses in the LTI segment are transitioning from the launch phase to the growth phase, especially in real estate, food and beverage, retail, B2B payments, and travel.

- Global Investment Incubation (GII) Segment: The GII segment generated ¥3.6 billion in investment business income. Efforts are underway to reduce earnings volatility by transferring investments off the balance sheet and shifting towards fund-type investments.

- Medium-Term Plan Progress: Digital Garage is making progress towards its medium-term plan targets, aiming to achieve them ahead of schedule.

Introduction and Company Overview

Kaoru Hayashi, Representative Director, President, Executive Officer, and Group CEO, began his presentation by introducing Digital Garage’s mission: designing a “new context” for a sustainable society through technology. He emphasized the company’s “first penguin spirit” and its corporate slogan, “New Context Designer DG.” He explained the company’s business model is built on three core technologies: Information Technology (IT), Marketing Technology (MT), and Financial Technology (FT). By integrating these technologies contextually, Digital Garage aims to capture technological evolution and achieve continuous growth.

History of Contextual Design and Social Implementation

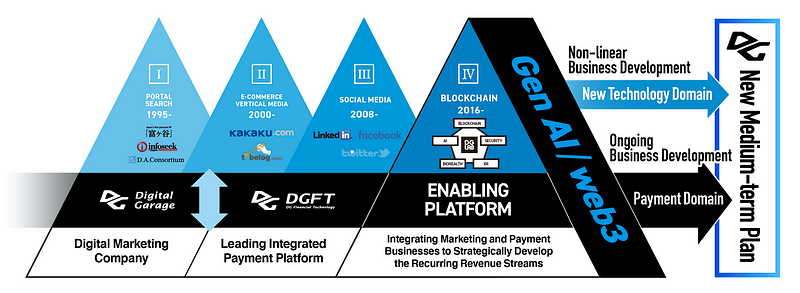

Hayashi then reviewed the historical phases of DG’s growth, highlighting its focus on deploying cutting-edge internet technologies, with marketing and payments as the core foundation.

- Phase 1 (1995–2000): Portal search business.

- Phase 2 (2000–2008): E-commerce, Consumer Generated Media (CGM), and vertical media. This phase included the incubation of successful destination sites like Kakaku.com and Tabelog.

- Phase 3 (2008–2016): Social media, with a focus on incubating services like LinkedIn and Facebook and promoting Twitter’s adoption in Japan.

- Phase 4 (2016-Present): Blockchain and enabling platform for non-linear business. This ongoing phase focuses on leveraging blockchain and other technologies like generative AI and Web3 for non-linear business development while continuing to expand its marketing and payment platform (linear business development).

Business Segment Formation

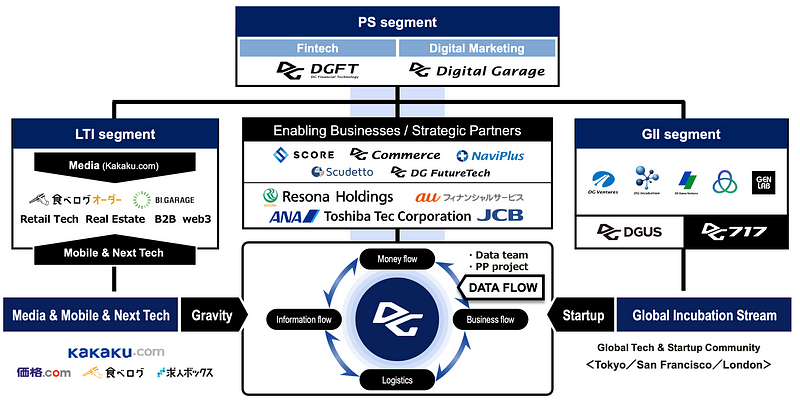

- Platform Solution (PS) Segment: This segment encompasses DG Financial Technology (DGFT) and Digital Garage (digital marketing). Key enabling businesses within this segment include Score (BNPL services), DG Commerce (e-commerce website creation and operation), NaviPlus (user navigation tools for e-commerce), Scudetto (cybersecurity), and DG FutureTech (development and operation support in India). Strategic partners include Resona Group, au Financial Service, ANA, Toshiba Tec Corporation, and JCB. The strategy revolves around integrating marketing and payment businesses and leveraging data to create new value.

- Long-Term Incubation (LTI) Segment: This segment focuses on incubating new businesses, with Kakaku.com as the key player. The “gravity” concept emphasizes funneling web and mobile traffic from various websites and services into the PS segment.

- Global Investment Incubation (GII) Segment: This segment invests in startups in Japan and overseas. It works with DGUS (U.S.-based) and DG717 (incubation center) to accelerate the social implementation of new technologies.

Medium-Term Plan: Targets and Progress

- Pre-tax Profit Growth: Target of at least 20% 5-year CAGR, driven by continued collaboration with Kakaku.com, expanding the payment business through strategic business groups, and monetizing SaaS-based revenues. Expansion of peripheral businesses centered on payments is also a key focus.

- Payment Transaction Volume: Target of at least ¥15 trillion by FY2028. This will be achieved by collaborating with specialized alliance partners and expanding offline payments through the Cloud Pay unified QR code payment solution.

- Investment Business Income: Target of at least ¥30 billion, derived from investment securities sales and other avenues. Progress is being made in moving investments off-balance sheet through a joint fund with Resona Group.

- Shareholder Return: Target of distributing at least ¥10 billion in ordinary dividends over five years. A progressive dividend policy is in place, and the ordinary dividend growth rate will be increased through the acceleration of strategic businesses.

Consolidated Financial Highlights and Strategic Actions

Keizo Odori, Vice President, explained the financial results in detail. The consolidated loss before tax was attributed primarily to the fair value valuation loss of Blockstream and rapid yen appreciation. Excluding these factors, the core business performance was strong.

- PS Segment: +13.8% profit increase in the first half of the fiscal year, with a +24.1% increase in the second quarter alone due to one-off revenue from an investment in a business partner. Within the PS segment, payment profit grew by +15.5% (+23.1% in Q2), driven by growth in general retail, financial accounts, restaurants, and travel. The marketing business is being restructured for better integration with the payment business.

- LTI Segment: +84.5% profit increase in the first half, driven by Kakaku.com’s strong performance. Several new strategic businesses are showing strong sales growth and market adoption.

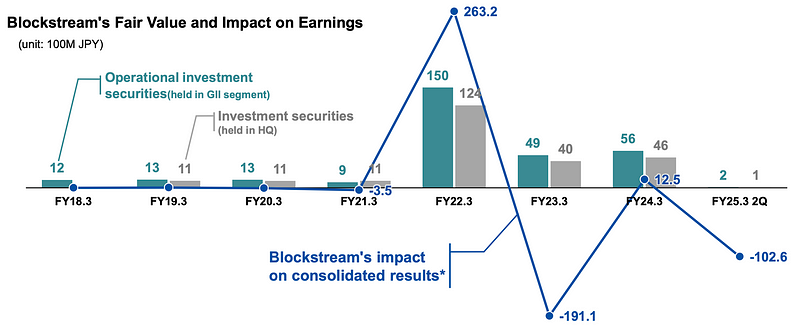

- GII Segment: Segment loss of approximately ¥10.2 billion due to the Blockstream valuation loss and yen appreciation. Efforts are underway to sell the investment portfolio and shift to a fund structure investment style to reduce earnings volatility.

Blockstream’s Fair Value and Impact

Odori discussed the volatility of Blockstream’s fair value, which has significantly impacted consolidated results in the past. Due to recent market fluctuations and a valuation loss recorded in Q2, the balance of Blockstream holdings is now negligible. The company anticipates limited future impact from Blockstream and other investments due to diversification and a shift to fund-type investments.

KPI Highlights

- Basic business profit (excluding investment business and one-time gains/losses): +6% growth.

- Payment transaction volume: +20% increase, driven by both online and offline payment growth.

- Investment business: ¥3.6 billion cash inflow from portfolio sales.

- New investments: Year-on-year decrease due to a more selective investment approach.

Segment Performance Highlights

- PS Segment: Steady revenue and profit growth. Cloud Pay, a common QR code payment solution, is expanding in the offline area. Focus remains on achieving 20% growth in payment business profit and 20–25% in PS segment profit growth.

- LTI Segment: New strategic businesses are now on track for growth, with a focus on achieving medium-term investment business income targets of ¥30 billion ahead of schedule.

- GII Segment: Aiming to achieve medium-term investment business income of ¥30 billion ahead of plan and reduce consolidated earnings volatility by moving investments off-balance sheet and shifting to fund-type investments.

Sustainability Initiatives

Digital Garage enhanced its information security framework, recognizing the importance of cybersecurity, particularly given the designation of its payment systems as critical infrastructure. The company announced GHG reduction targets and its commitment to carbon neutrality by 2050. The publication of an integrated report covering sustainability information is scheduled for the end of 2024.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.