Datachain & Progmat agree on revenue share for stablecoin business

Datachain Corporation has reached an agreement with Progmat on a revenue sharing contract in the stablecoin business. Under this contract…

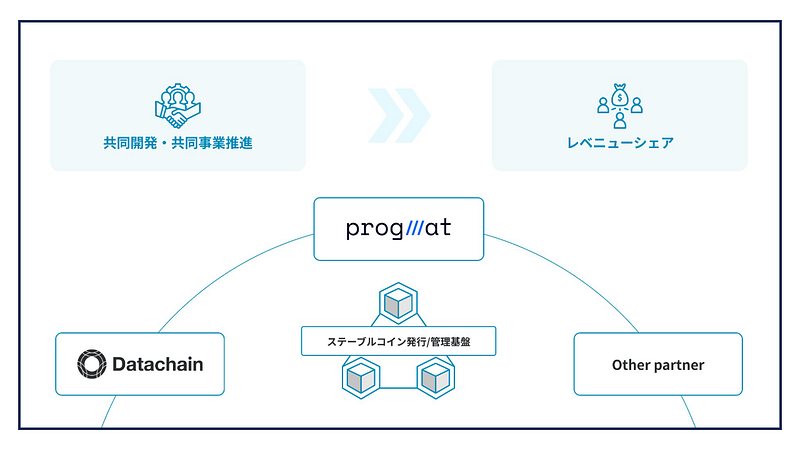

Datachain Corporation has reached an agreement with Progmat on a revenue sharing contract in the stablecoin business. Under this contract agreement, Datachain will receive a portion of the revenue generated from stablecoins issued through “Progmat Coin,” Progmat’s stablecoin issuance management platform. Through this contract, Datachain will further strengthen its collaboration with Progmat to maximize the issuance and circulation volume of stablecoins utilizing “Progmat Coin.”

Regarding the Revenue Share Contract Agreement

Datachain has been working with Progmat to promote business utilizing the stablecoin issuance management platform “Progmat Coin”. Specifically, Datachain has collaborated in the following areas:

- Development of smart contracts to provide registration, issuance, and transfer functions on multiple blockchains, as well as bridge functions between multiple blockchains for stablecoins issued on the “Progmat Coin” platform.

- Business development to create international use cases such as cross-border payments using stablecoins issued on the “Progmat Coin” platform.

Under this revenue share contract, Datachain will receive a portion of the revenue generated from stablecoins issued through “Progmat Coin.”

Typically, the relationship between a platform provider and a software development company takes the form of the software development company being contracted for services. However, this agreement was reached because Datachain is involved in the joint development of core components of the stablecoin issuance management platform.

Reference: Revenue of Stablecoin Issuers

As of October 2024, the global stablecoin issuance balance has reached approximately 26 trillion yen, with Tether’s USDT and Circle’s USDC accounting for about 90%. Industry leader Tether reported a net profit of 4.52 billion USD (approximately 678 billion yen) in Q1 2024. Second-ranked Circle achieved sales of 779 million USD (approximately 116.9 billion yen) in the first half of 2023.

According to a Bernstein report, the stablecoin market is expected to grow approximately 22-fold from 125 billion USD (about 18.8 trillion yen) in 2023 to 2.8 trillion USD (about 420 trillion yen) by 2028. This represents about 10% of the current fiat currency issuance.

The report suggests that this growth will be supported by stablecoins operating under national regulations. While stablecoin usage is currently limited mainly to the cryptocurrency sector, the emergence of regulation-compliant stablecoins is expected to create new revenue opportunities through adoption in business-to-business payments and retail payments in the real world.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.