DAM, InterTrade and Fireblocks partner to support adoption of Web3 infrastructure

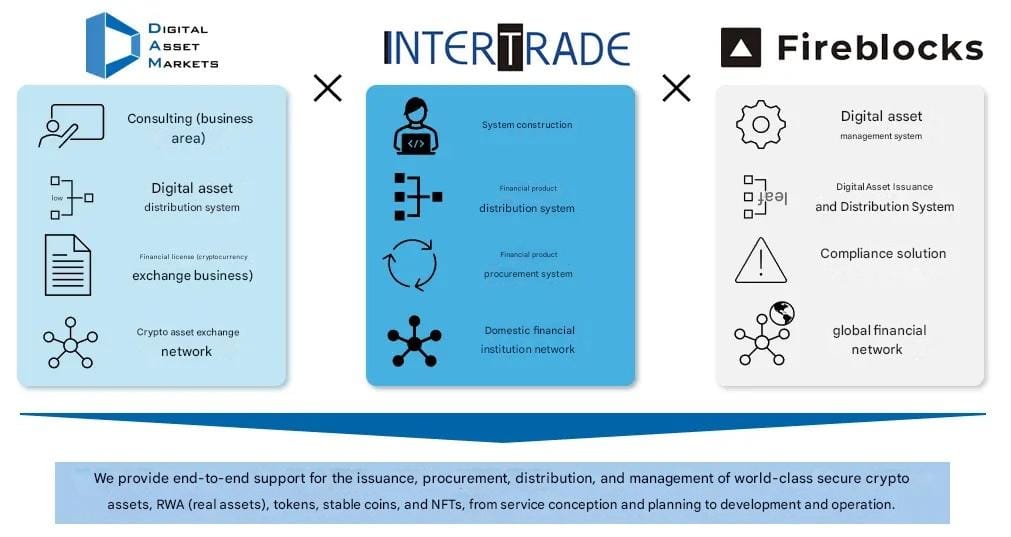

Digital Asset Markets has formed a strategic partnership with Intertrade, a software house for financial institutions and a shareholder of DAM, and Fireblocks, a digital asset infrastructure provider, to support the creation of Web3 infrastructure for Japanese companies.

Background

Financial services based on Web3 technology have undergone rapid technological innovation in recent years, including the approval of cryptocurrency ETFs by the U.S. Securities and Exchange Commission (SEC) and the success of the tokenized fund BUIDL by BlackRock, a major U.S. asset management company. Further dramatic changes are expected in 2025 with the reelection of Donald Trump in the U.S. presidential election.

In Japan, too, the development of the Web3 industry is part of a national strategy, and with a wide range of discussions underway to promote mass adoption, such as the application of the Financial Instruments and Exchange Act to crypto assets, the application of separate taxation, the establishment of a new crypto asset intermediary business (tentative name), and the flexibility of management and operation methods for matching funds for the issuance of stablecoins, it is expected that new Japanese companies will continue to enter the market and the market will expand.

About the Strategic Partnership

Intertrade provides package software such as the dealing system "Tiger Trading Platform" for securities companies, the cover system "fortissimo" for foreign exchange margin traders, and the general cryptocurrency trading and management platform "Spider Digital Transfer". With an eye on new business opportunities arising from blockchain technology innovation, the company is working with its equity method affiliate Digital Asset Markets to support the development of Web3 services for major companies. In the midst of this, the company has noticed an increasing demand for stronger security and decentralized systems among Japanese companies, and has recognized the need to build strong on-chain security for digital assets.

Fireblocks is a globally trusted and proven company in the digital asset infrastructure field, providing a comprehensive platform for operators to help them build, run and grow their businesses on the blockchain. Fireblocks' solutions provide high security and scalability, and streamline custody, tokenization, settlement, liquidation and trading operations. Fireblocks also works with major exchanges, custodians, banks, payment providers and stablecoin issuers to build a broad ecosystem. Currently, more than 2,000 companies, including BNY Mellon, Galaxy and Revolut, use Fireblocks' technology to secure over $7 trillion in digital asset transactions across more than 100 blockchains and more than 250 million wallets. Fireblocks has established a Japan office in 2024 and are seeking partnerships necessary for their Japanese market strategy.

The two companies have agreed on a strategic partnership based on the alignment of their business directions and strategies and the expectation of certain synergies.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on LinkedIn, or directly here on the platform.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.