Daiwa Securities reports second quarter earnings

Daiwa Securities reported surging profits as gains from wealth and asset management drove performance on the back of increased investor…

Daiwa Securities reported surging profits as gains from wealth and asset management drove performance on the back of increased investor interest in the stock market. Net income at Daiwa jumped more than 80% from a year earlier, eclipsing analyst by nearly 50%. Under its mid-term plan, Daiwa aims to raise its pretax profit to at least ¥240 billion for the year ending March 2027. The firm also intends to hire more bankers for its M&A business, as well as for Japanese equity trading to capitalize on the upturn in the nation’s stock market.

Key Highlights

- Record Performance: Consolidated net operating revenues and ordinary income for the first half of FY2024 reached their highest levels since the current consolidated accounting system was implemented in FY2000. Consolidated ordinary income for Q2 FY2024 also reached its highest point since Q4 FY2005.

- Wealth Management Growth: The Wealth Management Division experienced significant growth, with asset-based revenues increasing by 23% year-over-year and net asset inflow reaching a 17-year high.

- Asset Management Success: The Asset Management Division saw increased revenue and profit due to expansion of assets under management and successful capital recycling.

- Steady Base Income: The relatively predictable base income, derived from Wealth Management, Securities Asset Management, and Real Estate Asset Management, grew by 27% year-over-year, contributing to a more stable business structure.

- Record Interim Dividend: The company declared a record-high interim dividend of ¥28 per share and set a full-year minimum dividend of ¥44 per share for FY2024 to FY2026.

Financial Summary

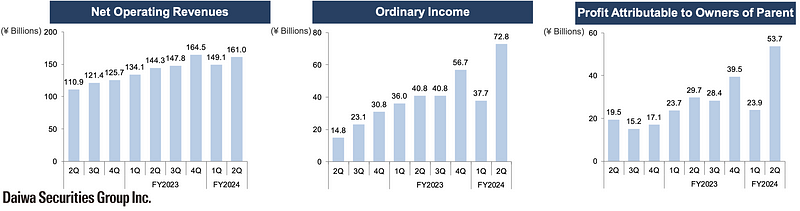

- Net Operating Revenues: Increased by 8.0% quarter-over-quarter and 11.4% year-over-year, reaching ¥161.1 billion in Q2 FY2024. For 1H FY2024, net operating revenues totaled ¥310.2 billion, up 11.4% YoY.

- Ordinary Income: Increased by 93.1% quarter-over-quarter and 43.8% year-over-year, reaching ¥72.9 billion in Q2 FY2024. For 1H FY2024, ordinary income reached ¥110.6 billion, a 43.8% increase YoY.

- Profit Attributable to Owners of Parent: Increased by 124.2% quarter-over-quarter and 45.4% year-over-year, reaching ¥53.8 billion in Q2 FY2024. For 1H FY2024, profit attributable to owners of parent totaled ¥77.7 billion, up 45.4% YoY.

- Total Assets: Decreased slightly by 0.5% from the end of the previous quarter to ¥33.7 trillion as of September 30, 2024.

- Shareholders’ Equity: Increased by 0.2% from the end of the previous quarter to ¥1.56 trillion as of September 30, 2024.

- ROE (Annualized): Reached 13.9% in Q2 FY2024.

Segment Performance

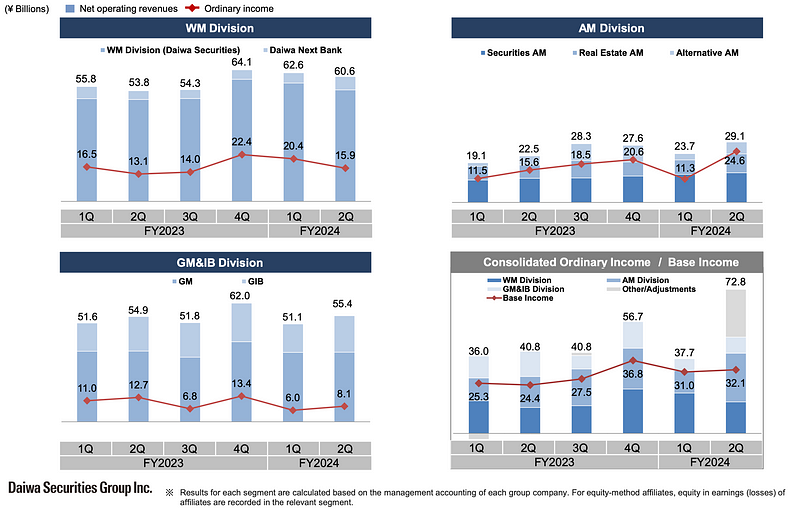

- Wealth Management: Experienced solid growth in both net operating revenues and ordinary income, driven by strong performance in wealth management services and increased asset-based revenues.

- Asset Management: Achieved record ordinary income, supported by net inflows in Securities Asset Management and growth in assets under management in Real Estate Asset Management.

- Global Markets & Investment Banking: Saw increased revenues and profits, with the Global Markets segment benefiting from strong institutional equity business and recovery in overseas FICC, and Global Investment Banking recovering.

Key Drivers and Trends

- Wealth Management Transformation: The ongoing shift towards a wealth management business model in the Wealth Management Division is contributing to more stable and recurring revenue streams. Despite market fluctuations affecting flow revenues, the growth in wrap account services and asset-based revenues demonstrates the success of this strategic direction.

- Asset Management Strength: Both Securities Asset Management and Real Estate Asset Management contributed to the strong performance of the Asset Management Division. Continued net inflows, especially into active funds and overseas equities, reflect investor confidence in Daiwa’s asset management capabilities. Real estate AUM reached a record high, further solidifying the division’s position.

- Global Markets Resilience: While FICC revenue faced headwinds from declining domestic interest rates, strong performance in foreign government bonds and foreign currency credits helped offset these challenges. Continued interest in Japanese equities from institutional investors supported growth in equity revenue.

- Investment Banking Recovery: The Global Investment Banking segment showed signs of recovery, with increased M&A activity both domestically and internationally. Several significant deals contributed to this positive trend.

- Overseas Operations: Overseas operations showed mixed results, with Europe seeing improvements in primary equity and M&A revenues, Asia/Oceania maintaining stable profits, and Americas benefiting from increased FICC revenue due to higher customer flows.

- Focus on Base Income: The consistent growth in base income demonstrates Daiwa’s commitment to building a more sustainable and less volatile business model. This focus on recurring revenue streams helps mitigate the impact of market fluctuations and supports long-term profitability.

Capital and Liquidity Management

- Strong Capital Position: Daiwa maintains a robust capital position, with the consolidated total capital ratio, Tier 1 capital ratio, and common equity Tier 1 capital ratio all well above regulatory requirements.

- Healthy Liquidity: The company boasts ample liquidity, with a high liquidity coverage ratio, providing a solid foundation for navigating market uncertainties.

Strategic Outlook

Daiwa Securities Group remains focused on its long-term growth strategy, centered around strengthening its wealth management business, expanding its asset management capabilities, and enhancing its global presence. The company is confident in its ability to deliver sustainable growth and value to shareholders by continuing to adapt to market dynamics and capitalize on emerging opportunities. The record interim dividend and the commitment to a full-year minimum dividend for the next three fiscal years reflect the company’s confidence in its future prospects and its dedication to rewarding shareholders.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.