Daishi Hokuetsu Financial Group and Gunma Bank agree to "integrate"

The Gunma Bank and Daishi Hokuetsu Financial Group have reached a memorandum of understanding aimed at realizing a business integration based on a basic policy of mutual trust and an equal integration.

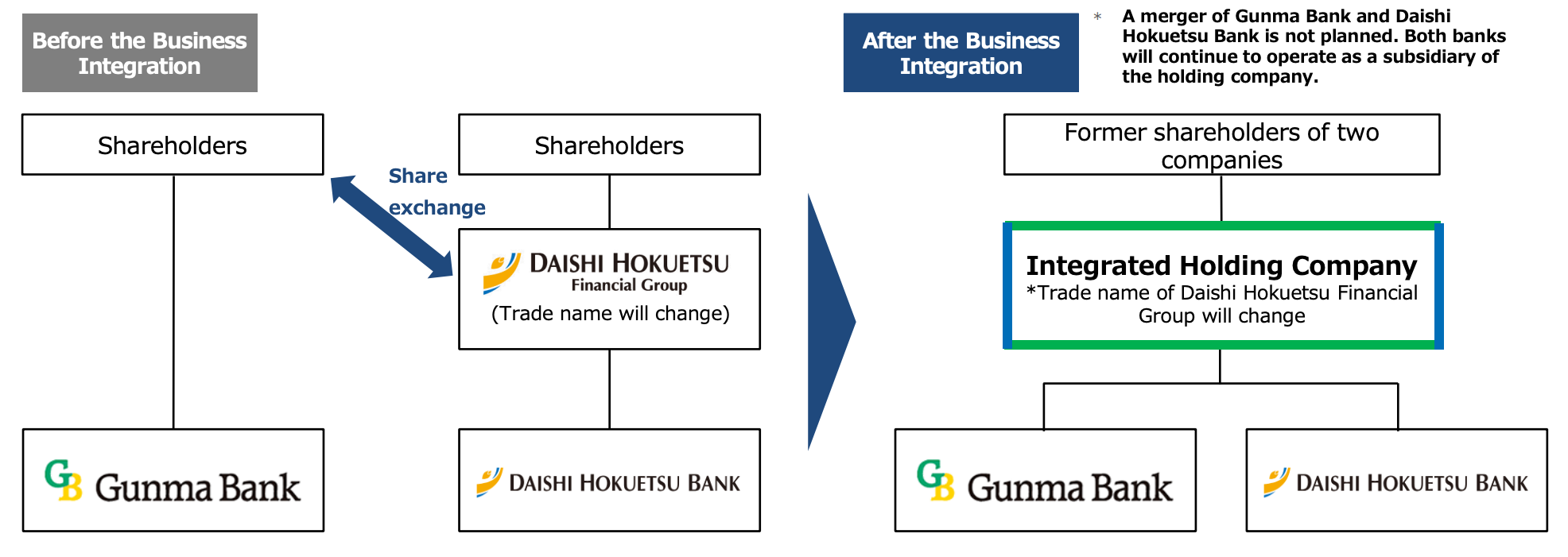

Such "integration" will take the form of repurposing Daishi Hokuetsu Financial Group's holding company into an Integrated Holding Company for both banks, but not necessarily eliminating or combining the two head-offices. The location of the Integrated Holding Company is yet to be determined.

Background of the Business Integration

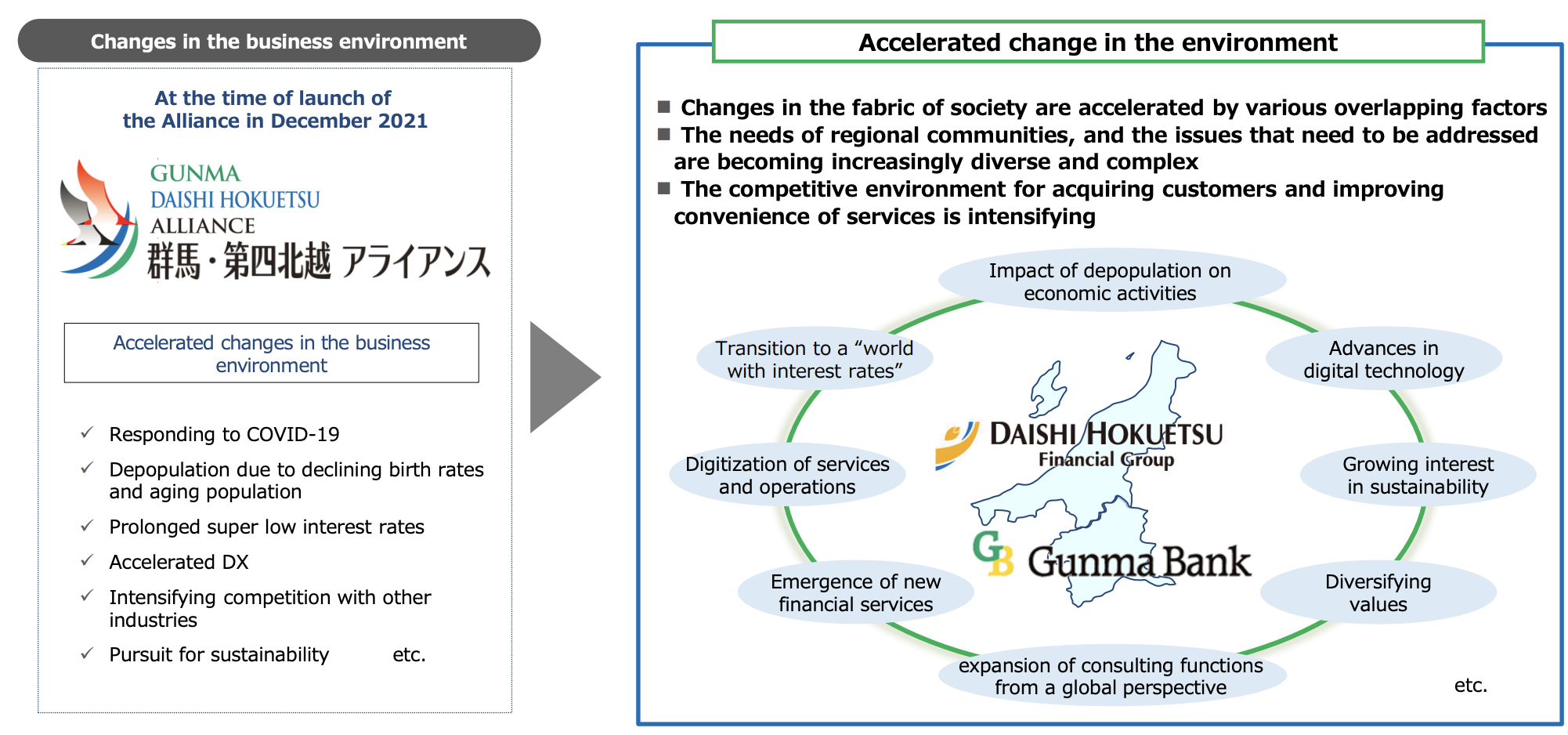

Gunma Bank is based mainly in Gunma Prefecture, while Daishi Hokuetsu Financial Group’s subsidiary Daishi Hokuetsu Bank is based mainly in Niigata Prefecture, and both Gunma Bank and Daishi Hokuetsu Bank (the "Two Companies") have been performing financial and information intermediary functions in their respective regions. Further, in 2021, the Two Banks entered into a “GunmaDaishi Hokuetsu Alliance” and have been working to contribute to their respective regions and sustainably increase corporate value while deepening cooperation.

In addition to being geographically adjacent to each other, Gunma Prefecture and Niigata Prefecture have well-developed transportation networks, including the Kan-Etsu Expressway and Joetsu Shinkansen bullet train lines, which provide easy access from the Tokyo metropolitan area, so there is a significant flow of people through both prefectures and a concentration of various industries. Furthermore, both prefectures are blessed with a natural environment through which some of Japan’s most well-known rivers flow, surrounded by mountains and offering a variety of seasonal scenery, which has enabled diverse agricultural, forestry, and fishery industries to develop, while the richly developed culinary culture of each region, along with World Heritage sites, such as the Tomioka Silk Mill and the gold mine on Sado Island, and some of Japan’s best hot spring resorts, are all attractive tourist resources that draw people to both prefectures.

At the same time, a combination of factors, including the impact of a declining population, falling birthrates, and the aging population on economic activities and labor markets in regional areas, advances in digital technology, growing interest in sustainability, and diversifying values, are accelerating changes in the fabric of society, causing the needs of regional communities, and the issues they must address, to become increasingly diverse and complex. In the financial sector, a transition from the long-standing low interest rate environment to a “world with interest rates” is progressing, and the digitalization of services and operations due to advances in technology and the emergence of new financial services with the spread of cashless payments are making the competitive environment increasingly fierce in terms of customer acquisition and the improving convenience of services, both within the same industry and with differing industries. Furthermore, as Japanese companies within the sales territories of the Two Company Groups expand overseas and transactions with companies outside Japan increase, there is demand for expansion of consulting functions from a global perspective, including the provision of expertise on overseas business development.

Based on this understanding of the environment, the Two Companies have determined that in order to enhance the value provided to customers and regions and to contribute to customer development and regional development in the future, and in order to establish a strong management base and grow sustainably together with their respective regions even in a difficult business environment, the optimal path is to bring together the Two Company Groups’ respective strengths as the top banking groups in their respective regions and collaborate in order to fulfill the expectations of all stakeholders and realize the management philosophies and purposes of the Two Companies, and so the Two Company Groups reached a memorandum of understanding to proceed with discussions and deliberations toward the realization of the Business Integration.

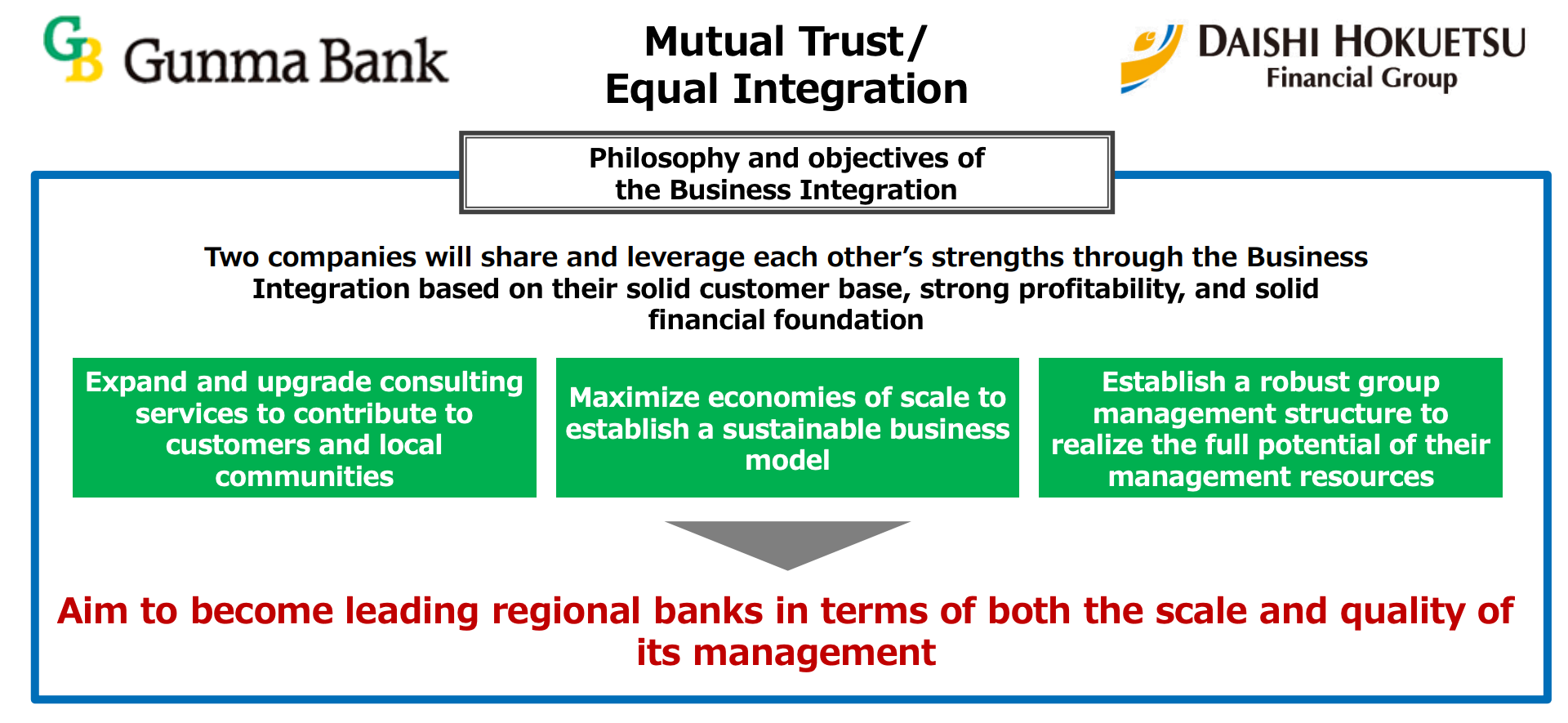

Philosophy and objectives of the Business Integration

The aim of the Business Integration is to facilitate the creation of a new financial group that constitutes one of the top regional banks, in terms of both the scale and quality of its management, by integrating the Two Companies, which already possess solid customer bases in their respective business areas and demonstrate strong profitability and solid financial foundations.

Based on a basic policy of mutual trust and an equal integration, the Two Companies will work to further contribute to their respective regions and continuously improve corporate value by consolidating their relationships of trust with customers and their understanding of their regions that they have cultivated in their respective business areas and by expanding and enhancing their consulting functions.

In addition, the Two Companies will build a sustainable business model for the future by maximizing the benefits of rationalization and efficiency through economies of scale and by providing added value to customers by leveraging their respective strengths.

Furthermore, the Two Companies will aim to become a valuable regional financial group that is able to fulfill customer, regional, and stakeholder expectations by developing a strong group management structure to maximize the potential of the Two Companies’ management resources and by steadily achieving sustainable growth and enhancing corporate value.

Synergistic effects anticipated from the Business Integration

The Two Companies will examine specific measures with a focus on the following synergies in order to achieve the objectives of the Business Integration as soon as possible and maximize the corporate value.

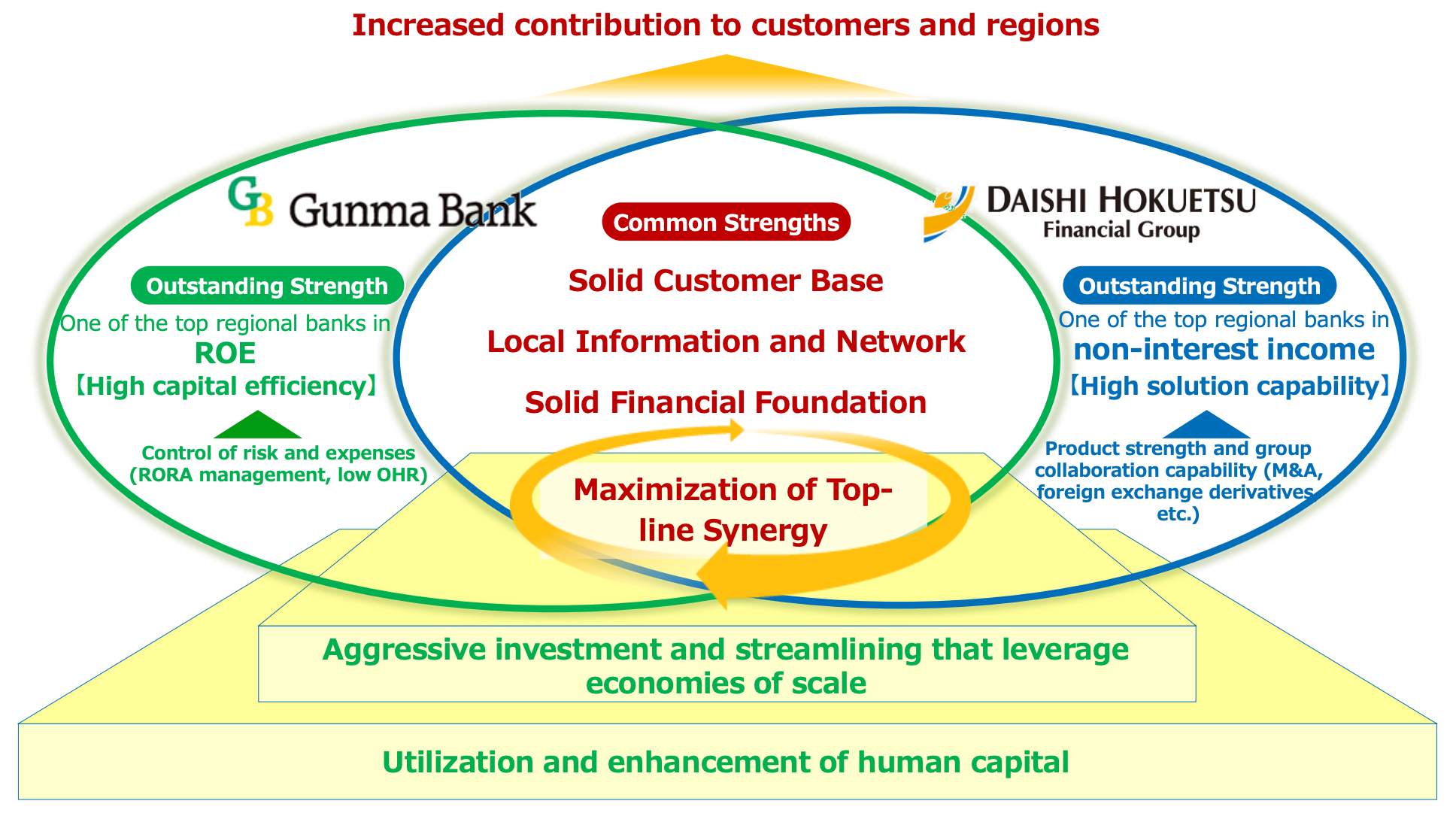

Increased contribution to customers and regions

By bringing together, and mutually utilizing, the respective strengths of the Two Company Groups, including expertise, information, and networks, the Two Companies aim to strengthen their ability to respond to increasingly diverse and complex needs and issues and to continue making a contribution to customers and their respective regions in the future.

In addition to utilizing various schemes, such as co-financing and joint arrangement of structured finance for client companies, to strengthen financial intermediary functions, the Two Companies will mutually cooperate and complement each other to provide high value-added services, such as the following: improved proposal-making capabilities, including in relation to business matching, business succession, and M&A, utilizing the Two Companies’ broad networks; start-up support; joint development and collaborative promotion of products and services; sophisticated consultation for asset management needs; and overseas business support utilizing overseas offices.

The Two Companies will also take on new business realms, such as fields that contribute to solving regional issues and fields where the provision of high added value can be anticipated through utilization of the Two Company Groups’ expertise and knowledge.

Aggressive investment and streamlining that leverage economies of scale

With respect to information systems, DX, and other priority areas, the Two Companies will deliberate aggressive investment to take advantage of economies of scale through the Business Integration, strive to expand customer channels and provide services of high quality and convenience, and seek to upgrade internal control systems, including risk management.

Gunma Bank is considering a plan whereby it would migrate to the TSUBASA core system currently used by five regional banks including Daishi Hokuetsu Bank when Gunma Bank’s core system will be upgraded after January 2029 onward, and streamlined operations and management will also be pursued through the standardization and consolidation of administrative procedures at Two Company Groups, shared use of stores and other facilities, integration and streamlining of head office organizational functions, and optimization of group structures.

Utilization and enhancement of human capital

In anticipation of a future where needs for expertise will increase and the range of expertise will broaden as the scale and scope of the integrated group’s business expands, the Two Company Groups will work to improve the value provided across the Two Company Group by developing a system that maximizes the skills and expertise of the Two Companies’ abundant human resources.

At the same time, the Two Companies will aim to form a corporate group that is appealing to workers, and where a diverse array of personnel is able to grow through a broad range of careers without being bound by corporate boundaries, by assigning the right people to the right positions and promoting autonomous career development.