Credit Saison Q2 Highlights

Credit Saison reported on the company’s performance for the first half of the fiscal year ending March 31, 2025 (FY2024). The key…

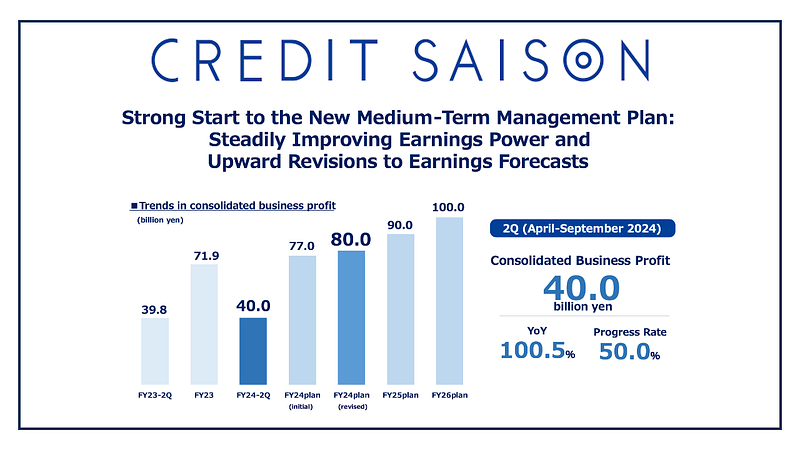

Credit Saison reported on the company’s performance for the first half of the fiscal year ending March 31, 2025 (FY2024). The key highlights of the results briefing included an update on the progress of the new medium-term management plan, the strong start to the plan with steadily improving earnings power and upward revisions to earnings forecasts, and a detailed discussion of the financial results digest for the second quarter of FY2024.

Update on the Medium-Term Management Plan

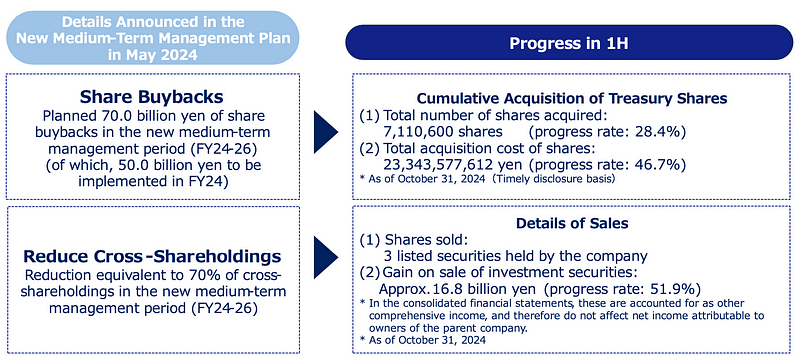

The briefing began with an update on the progress of the medium-term management plan, which was announced on May 15, 2024. Three key points were highlighted that have attracted attention from the market: confidence level in achieving the targets, background to enhanced disclosures for capital policy, and strengthening IR activities.

The first point is the company’s confidence in achieving the goals of the medium-term management plan. Credit Saison is targeting consolidated business profit of JPY100 billion and ROE of 9.5% by FY2026. Second, the company has enhanced its disclosure on capital policy, purchasing approximately JPY70 billion of treasury stock, exceeding market expectations and achieving a payout ratio of over 30%. This represents a significant shift in Credit Saison’s capital policy, which has historically not been clearly articulated, and has drawn considerable market attention.

The third point is strengthening IR activities. The company has actively engaged in investor meetings, with executives in charge of individual areas, such as global and DX, directly communicating the company’s approach and progress to investors. This proactive IR approach reflects Credit Saison’s commitment to transparency and building strong relationships with investors.

Financial Results for the Second Quarter of FY2024

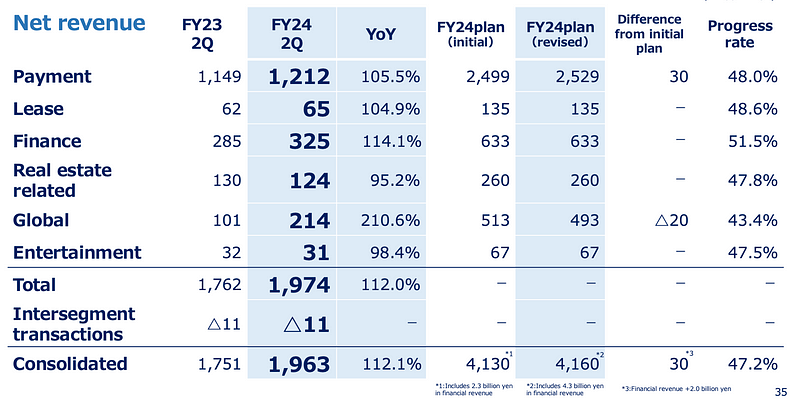

In the second quarter of FY2024, net revenue increased to JPY196.3 billion, representing a year-on-year growth of 112.1%. Business profit reached JPY40 billion, a 100.5% increase compared to the same period last year (see headline chart). Interim income stood at JPY28.4 billion, a decrease of 35.4% year-on-year, primarily due to the absence of the gain on negative goodwill from the equity participation in Suruga Bank in the previous year. Despite this, both net revenue and operating income remained strong, leading to an upward revision of the full-year plan by JPY3 billion for each.

Business Segment Performance

The presentation also included a breakdown of the business results by segment. The payment business saw net revenue of JPY121.2 billion, a 105.5% increase year-on-year. The steady progress in revolving credit use was a key contributor to this growth. The full-year plan for the payment business was revised upward by JPY3 billion to JPY252.9 billion, reflecting the positive momentum.

The global segment recorded JPY21.4 billion in H1, a substantial 210.6% increase compared to the previous year. While the lending business, particularly in India, showed steady progress, the investment business experienced valuation losses in some portfolio companies. Consequently, the full-year plan for the global segment was revised downward by JPY2 billion to JPY49.3 billion.

The finance segment performance was particularly strong, recording JPY17.2 billion in profit, a 140.9% increase year-on-year. This was driven by the robust performance of the real estate finance and credit guarantee business of Credit Saison and Saison Fundex, along with contributions from Suruga Bank, which became an equity affiliate in the previous year.

Capital Policy and Corporate Value Initiatives

The company provided an update on its capital policy, highlighting the progress in treasury stock acquisition and reduction of cross-shareholdings. Credit Saison has already purchased JPY23 billion worth of treasury stock, making progress towards its JPY50 billion target for FY2024. The company has also sold three listed holdings, resulting in a gain of JPY16.8 billion, as part of its plan to reduce cross-shareholdings.

In terms of improving corporate value, Credit Saison is focusing on human resource development, particularly in developing specialists and promoting comprehensive financial consulting. The company is also implementing initiatives to improve employee engagement and create a culture of ownership by linking employee compensation to business results and stock price.

CSDX Initiatives and Generative AI

Credit Saison shared its progress on CSDX (Credit Saison Digital Transformation) initiatives, including the creation of digital human resources and the complete digitalization of business processes. The company is also actively exploring the use of generative AI, leveraging tools like in-house ChatGPT “SAISON ASSIST,” Chatbot “FAQ Assist-kun,” and meeting minutes creation system “SCRIBE ASSIST.” The company plans to further explore the potential of generative AI to automate operations and improve productivity.

Credit Risk Management

The company addressed credit risk, acknowledging the gradual increase in delinquency rates over 90 days. This has led to increased bad debt costs in the payment business. Credit Saison emphasized its focus on enhancing credit monitoring and improving debt collection processes to mitigate this risk. The company is implementing various measures, including strengthening predictive analysis models using machine learning, enhancing counseling services, and leveraging external partnerships with law firms.

Conclusion

Credit Saison’s financial results briefing provided a comprehensive overview of the company’s performance in the first half of FY2024. The strong financial results, along with the progress on the medium-term management plan, demonstrate the company’s commitment to sustainable growth. The company is actively adapting to changing market conditions, leveraging technological advancements like DX and AI, and strengthening its risk management practices to ensure long-term success. While challenges remain, particularly in managing credit risk, Credit Saison’s proactive approach and focus on strategic initiatives position the company for continued growth in the future.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.