CIC to launch credit score

CIC Corporation, which is the credit information agency designated under the Installment Sales Act and the Money Lending Business Act, will…

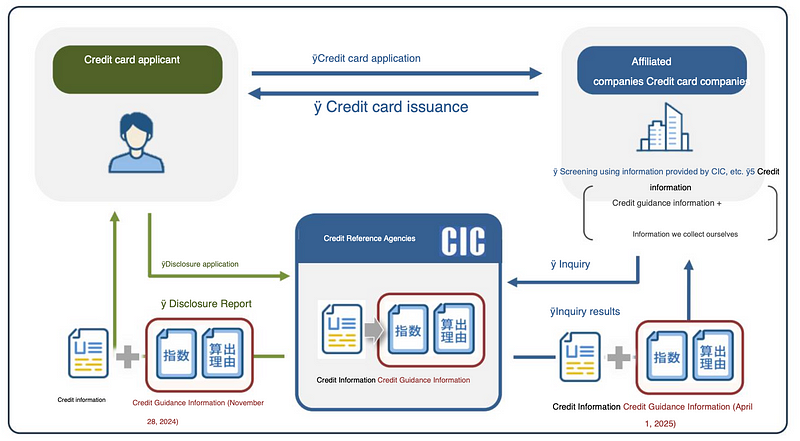

CIC Corporation, which is the credit information agency designated under the Installment Sales Act and the Money Lending Business Act, will begin offering “Credit Guidance”, essentially a credit score with limited explanations, to member companies and consumers. In order to deepen consumers’ understanding of “Credit Guidance,” the company will begin offering it to consumers prior to offering it to member companies.

Background

Since its establishment in 1984, CIC has supported appropriate credit for member companies through credit information provision and other services, and contributed to the sound development of the consumer credit market. In order to realize appropriate credit and prevent multiple debts, CIC has expanded both the quantity and quality of credit information. As a result, the number of credit information held by CIC has reached over 800 million items in the 40th year since its establishment.

In light of the current situation in which CIC has a high level of comprehensive credit contract information, CIC has decided to develop and provide “Credit Guidance” as a highly unique service that only CIC can provide, in order to create new added value in the consumer credit market by utilizing the credit information it holds, after repeated consideration, including exchanges of opinions with external experts.

Overview of “Credit Guidance”

“Credit Guidance” is a service that provides member companies and consumers with “credit guidance information” that includes “indexes” calculated based on the analysis of credit information held by CIC and the “reason for calculation.”

- An index (a three-digit number between 200 and 800) that represents credit status calculated based on “objective transaction facts (payment status, balance, etc.)” excluding items related to attributes (age, sex, place of employment, place of residence, etc.) from credit information

- Up to 4 reasons that have had a particular impact on the calculation of the index, for example: “There are no outstanding payments, which has a positive impact on the index.”

From November 28, 2024, onwards, consumers can request disclosure of “Credit Guidance Information” when using the information disclosure system, and can check the “Credit Guidance Information” along with their own credit information. In addition, it is possible to suspend provision to member companies (and lift the suspension) by completing the required procedures with CIC.

From April 1, 2025, onwards, member companies can receive “Credit Guidance Information” along with their credit information by applying to use “Credit Guidance” and requesting an inquiry from CIC. The use of “Credit Guidance Information” by member companies, like credit information, will be limited to the situation of investigating the ability to repay, such as initial credit for contract applicants and ongoing credit for existing customers.

Features of “Credit Guidance”

Providing objective and highly accurate indexes

- When calculating the “Credit Guidance Information” index, only objective transaction facts (payment status, balance, number of contracts, contract period, number of applications) from the credit information registered with CIC are used; credit information includes attributes such as age, gender, place of employment, and place of residence, but these are not used to calculate the index. In addition, annual income, assets, etc. are not included in CIC’s credit information. Therefore, these “attributes” of consumers do not affect the index in any way.

- Credit Guidance” has achieved high accuracy through statistical analysis of comprehensive credit information . Even after the service starts, CIC will maintain and improve the quality through regular accuracy verification and advice and evaluation by external experts.

Ensuring transparency

- When calculating the index, CIC uses statistical analysis methods that allow it to clearly explain the reasons for the calculation, and do not use methods such as AI that may become a black box. CIC ensures the transparency of its services by providing not only the index but also the reasons for its calculation.

- The index and the calculation reasons will be provided to consumers; consumers can check the information they provide to member companies through the information disclosure system.

Ensuring safety and security

- Of the member companies to which consumers have applied and signed a contract, the purpose of using the “Credit Guidance Information” is limited to investigating repayment ability, and use for any other purpose is strictly prohibited.

- CIC not only complies with the Personal Information Protection Act, but also has established an extremely strict personal information protection system as a designated credit information agency under both the Installment Sales Act and the Money Lending Business Act; CIC will strictly manage “credit guidance information” under the same security environment as credit information; CIC also requires its member companies to manage such information in the same strict manner.

- The provision of “Credit Guidance Information” to member companies can be suspended (and the suspension can be lifted) by following the prescribed procedures, and no fees are required in either case; in addition, consumers can check the “Credit Guidance Information” through the information disclosure system even during the suspension period.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.