Adjusting mortgage terms to rising real estate prices

Rakuten Bank has raised the upper limit of the loan amount for the “Rakuten Bank 50-Year Home Loan (Reasonable Repayment Plan),” which…

Rakuten Bank has raised the upper limit of the loan amount for the “Rakuten Bank 50-Year Home Loan (Reasonable Repayment Plan),” which allows the borrowing period of a home loan to be up to 50 years, from 100 million yen to 200 million yen.

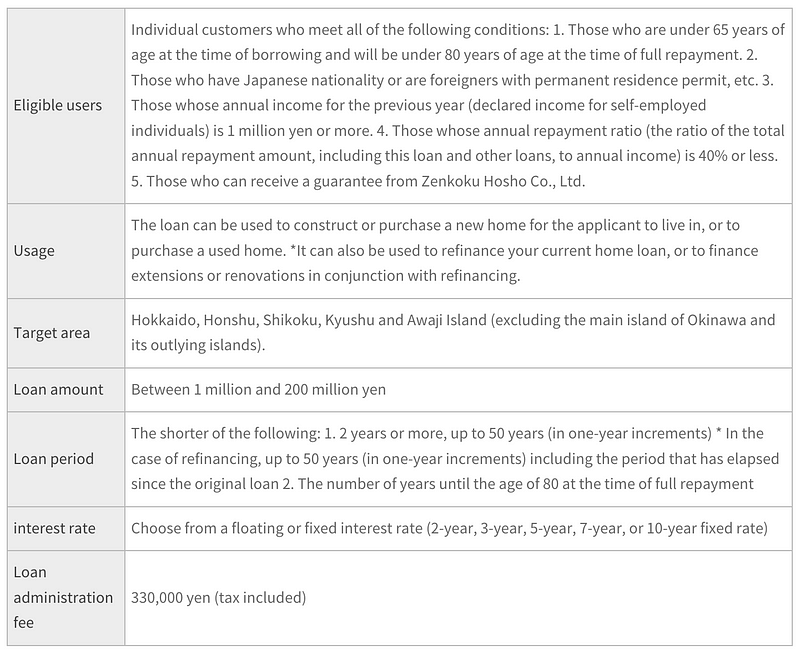

The “Rakuten Bank 50-Year Home Loan (Reasonable Repayment Plan)” was launched in March 2024 to respond to changes in customers’ lifestyles and diverse needs for home loans, and to allow customers considering purchasing a home to consider a comfortable home loan repayment while reducing their monthly repayment amount. It has been well received for its convenience of being able to apply without visiting a branch, its attractive interest rate setting, and its flat loan administration fee of 330,000 yen (tax included).

With this increase in the upper limit of the loan amount, Rakuten Bank will be able to meet the needs of customers who wish to take out new loans or refinance home loans for properties over 100 million yen.

Please follow us to read more about Finance & FinTech in Japan, like hundreds of readers do every day. We invite you to also register for our short weekly digest, the “Japan FinTech Observer”, on Medium, on LinkedIn, or on Substack.

We also provide a daily short-form Japan FinTech Observer news podcast, available via its Podcast Page. Our global Finance & FinTech Podcast, “eXponential Finance” is available through its own LinkedIn newsletter, or via its Podcast Page.

Should you live in Tokyo, or just pass through, please also join our meetup. In any case, our YouTube channel and LinkedIn page are there for you as well.